Top 10 Front Running Biases in Handicap Chases, Part 1: 10 to 6

The Top 10 front running biases in handicap chases Part 1 – 10 to 6

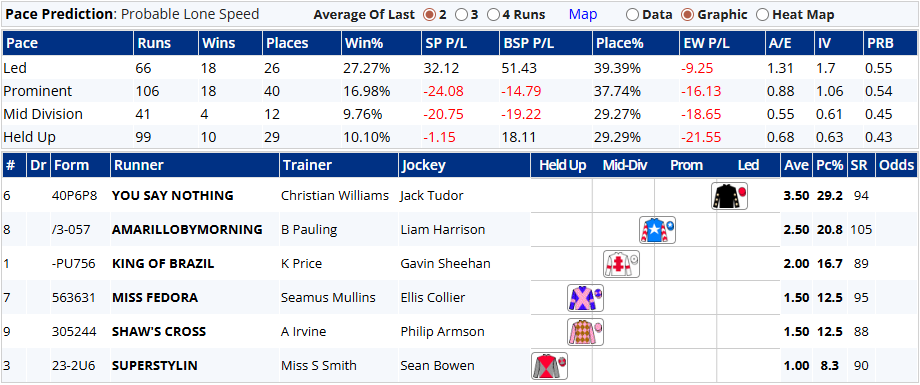

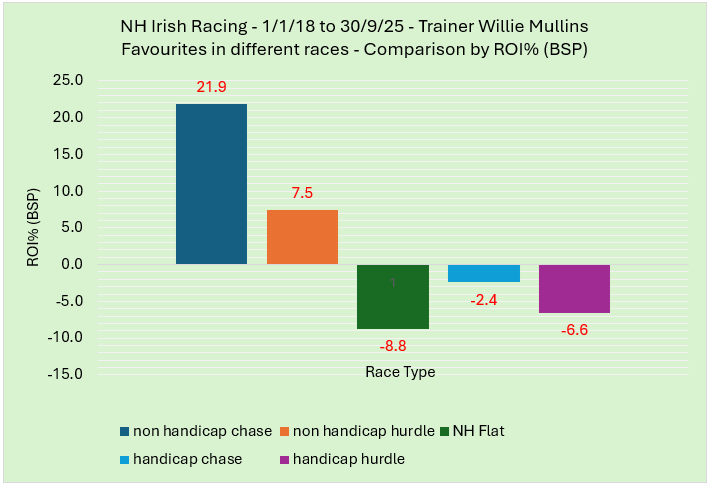

Over the next two articles I will share what I believe to be the Top Ten current run style handicap chase front running biases in the UK and Ireland, writes Dave Renham. In this first half, I will reveal positions 10 down to 6; and next week I'll reveal my top five. Of course, I appreciate that there will be people who disagree with my hierarchy but, ultimately, all ten biases have shown themselves to be profitable to deploy alongside more traditional form reading. As a bonus, today I will also share three near misses that narrowly failed to make the top ten.

Introduction

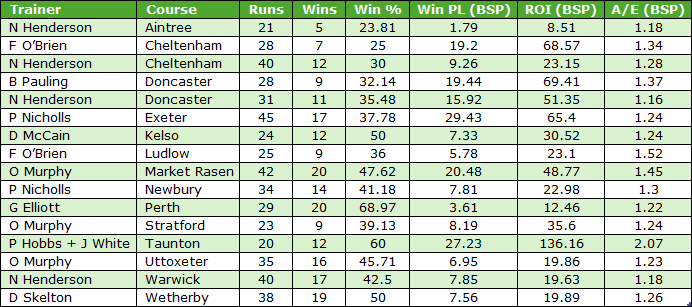

To compile my top picks, I have used data for handicap chases only as they are not so prone to distortion by the ability range of the horses competing. Data are from 2018 to 2024 with no minimum runner consideration.

I mentioned in a recent offering that Gold members of Geegeez have so many benefits and one of these is access to the Pace Analyser. This allows users to dive into run style / pace biases at any racecourse in the UK and Ireland. The data can be filtered based on going, field size, distance and race type. There is also the option to separate hurdles and chase (and NH Flat) data at jumps courses; and across all courses the data can further be filtered by year to allow for possible changes in any bias. The Pace Analyser is ideal for research such as this, and it was the main source that I used to produce what follows.

The run style data on Geegeez is split into four groups - Led, Prominent, Mid Division and Held Up. A quick refresher of which type of horse fits each profile:

Led – horses that lead early, usually within the first furlong or so; or horses that dispute or fight for the early lead.

Prominent – horses that lay up close to the pace just behind the leader(s).

Mid Division – horses that race mid pack.

Held Up – horses that are held up at, or near the back of the field.

Near Misses

In general, the ‘led’ group has an edge in most handicap chases. Some courses offer a stronger edge than others and hence let me start by looking at the C&Ds that were near misses:

Exeter 2m3f

To get this distance on Geegeez we need to use the 2m4f distance figure on the Query Tool / Pace Analyser as distances are grouped every two furlongs. It should be noted, too, that some race distances at a track change slightly sometimes due to rail adjustments. This happens more and more these days, or at least it is more accurately reported these days!

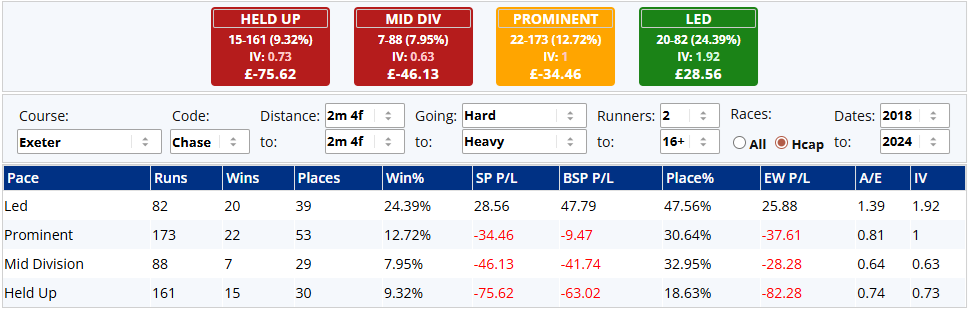

Let me share the Exeter figures taken from the Pace Analyser:

This is a good time to note that not all run style groups have the same number of runners; there are always going to be far more hold up horses than front runners / early leaders. However, despite the ‘led’ group having just 82 qualifiers compared with the held-up group of 161, they have still won 20 races compared with 15. The Win%s in the table show the strike rate within each run style group, and for this article that is how I will quantify ‘win strike rate’.

The ‘led’ group produced by far the highest percentage at 24%. That is, 24.39% of the horses that led early went on to win their races. (They actually won 31.25% (20/64) of all races in the sample).

Leaders' place percentage was comfortably the best too, with 47.6% of early leaders still in the frame at the finish line; while their A/E index of 1.39 indicates that front runners were very good value.

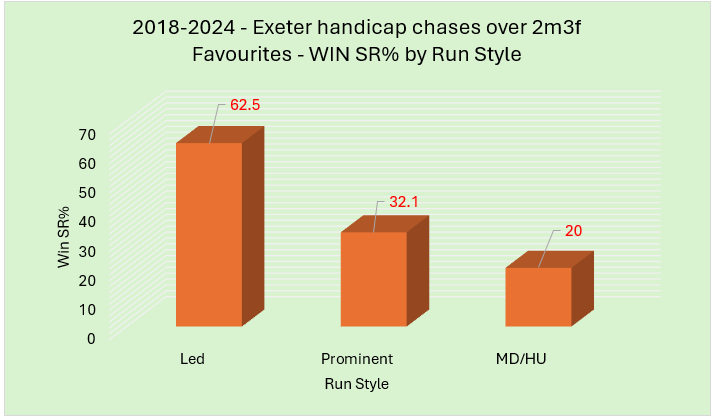

If we considered favourites only in these races and their performance by run style, we have seen the following win strike rates splits (I have combined favourites whose run style was either Mid Div or Held Up):

Front runners / horses that contested the early lead had an outstanding record when favoured by the market. However, it's a different story for those favourites that raced mid pack or at the back early. As can be seen, the bias over this course and distance has been very strong indeed, but still it wasn't quite enough to make my top ten. Exciting times ahead, then!

Before moving on, in terms of what has happened in 2025, of the eight races to date, five have been won by front runners.

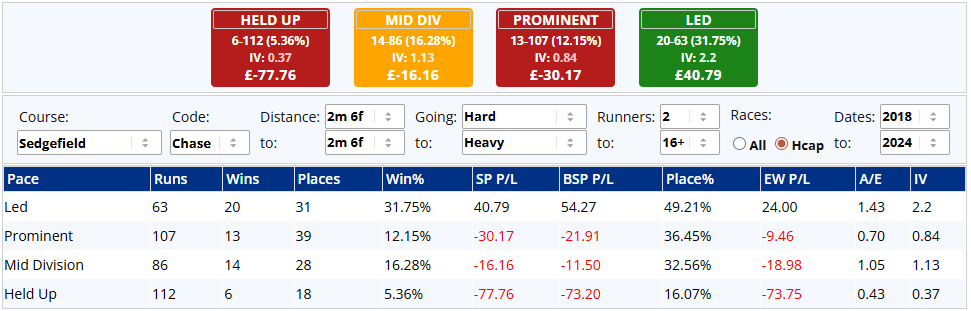

Sedgefield 2m5f to 2m5½f

Using the Geegeez tools we use the 2m6f distance.

Front runners have hit a win rate in excess of 30% and the only reason this track/trip did not make the list is due to the relatively strong stats for horses that raced in midfield early. Also, the 2025 stats to date have seen horses racing mid-pack early doing well and winning three of the six races to date.

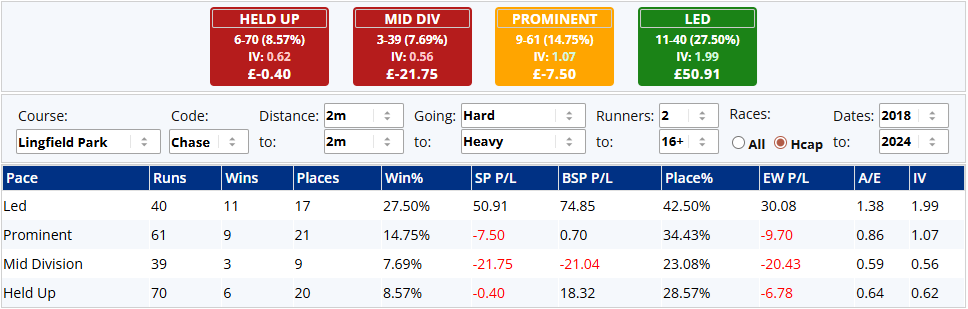

Lingfield 2m

The stats were as follows:

Strong figures again for front runners, although this is another course and distance (C&D) where qualifying races were relatively infrequent (only four races per year on average). Indeed, at the time of writing there has been just one qualifying handicap chase in 2025, but it was won by the early leader as we can see:

It is also worth noting that he was projected as the 'probable lone speed' in the race:

OK, near misses shared; onto position ten in my list.

Top 10, 10 to 6

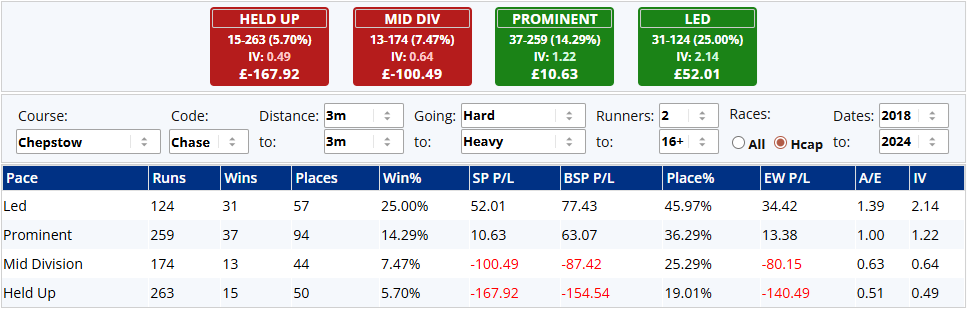

#10 Chepstow 3m

Some readers may expect front runners to be at a disadvantage over longer distances in handicap chases: surely for a horse to lead from start to finish in a 3-mile race would not be any easy assignment, right? However, looking at the Chepstow breakdown I suspect might change a few minds!

Front runners have bossed these races over the past few seasons, while prominent racers have been clearly second best with much better stats than horses which raced off the pace. 68 of the 96 winners raced close to the pace or at the front - that's 71% of the winners from 47% of the runners. And a front runner has been over four times more likely to win than a hold up horse when analysing the win percentage within their respective groups (25% versus 5.7%).

Now, as stated earlier, we get more hold up horses than front runners in most races and there were just over twice as many hold up horses compared to front runners between 2018 and 2024. That means therefore that when talking purely about race wins, front runners have won just over twice the number of races than hold ups.

There have been seven races this year so far with two being won from the front.

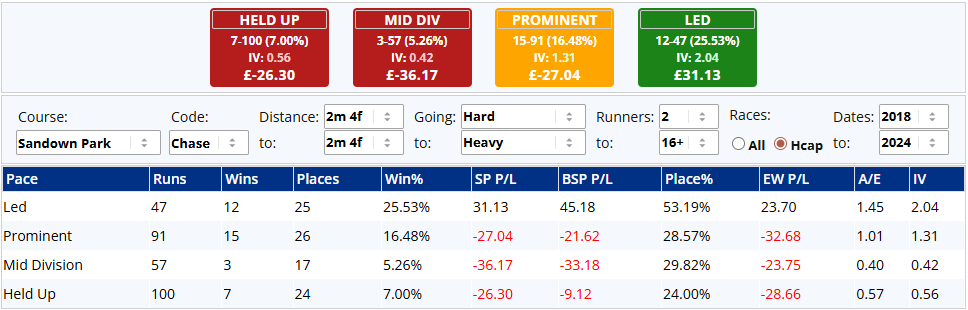

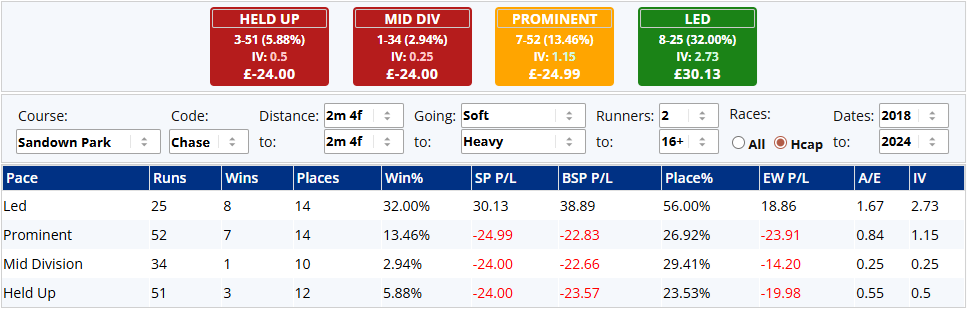

#9 Sandown 2m4f

It is time to head to Surrey now, and specifically Esher, to look at the 2m4f stats from Sandown. The run style splits for this time frame were as follows:

It's a similar story to Chepstow’s 3-mile trip but front runners have had a better place record here, hitting over 53%. There have not been that many qualifying races per year (roughly five to six) but keep an eye out for confirmed front runners when they race over this C&D. Those on the early lead have had an even stronger edge on soft/heavy ground as can be seen below:

From Sandown we head up country to Haydock.

#8 Haydock 2m3f-2m5f

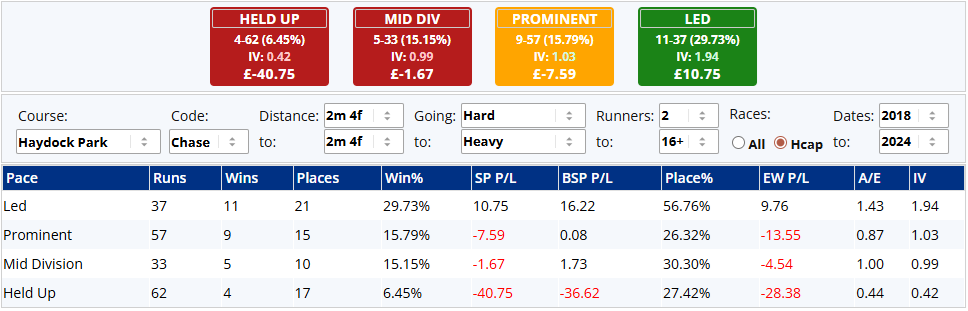

Haydock seemed to have 'played around' a little with the usual 2m4f trip occasionally adding or dropping a furlong. Hence, I have combined results together a furlong either side of two and a half miles. Let me share the run style stats:

There has again not been a huge number of races each year, but the front running numbers were extremely strong over the period of study. 11 of the 29 races were won from the front and that cohort also had an outstanding place record. Hold up horses really struggled in terms of winning, though they fared better from a placed perspective.

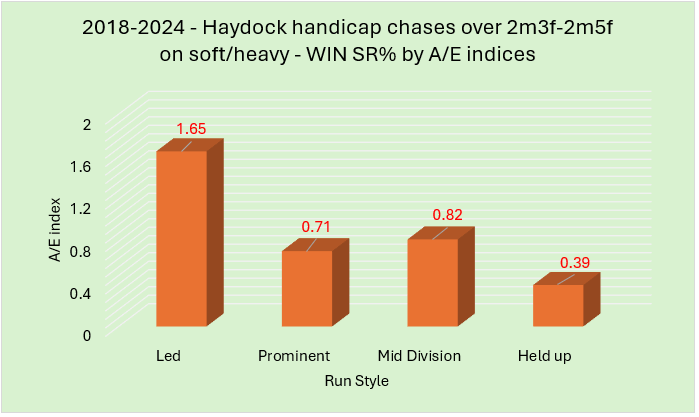

Haydock, like Sandown, has seen the front running bias strengthen on softer ground. On soft or heavy the run style win strike rates were as follows:

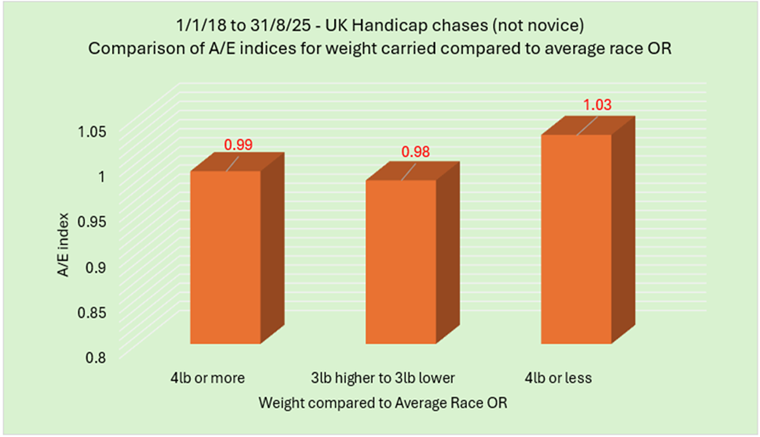

It should be noted the sample size stands at only 17 races. The A/E indices correlate strongly as the graph below shows:

All in all, Haydock over 2m4f has strongly favoured horses racing at the front end.

#7 Carlisle 2m4f

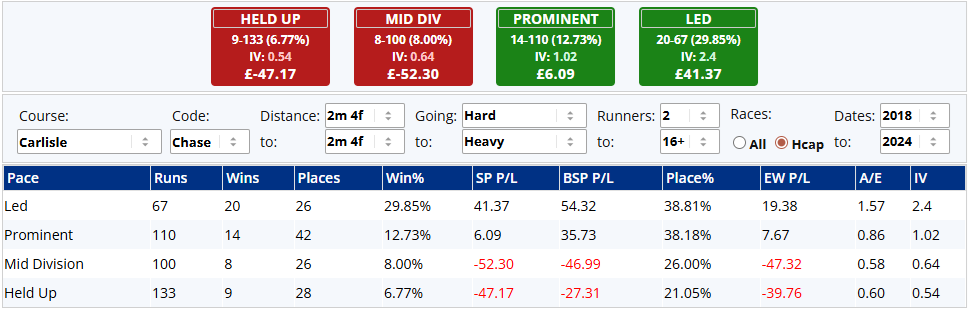

Staying north for number seven, as we head to Carlisle next. The run style splits were:

It could be argued that both Haydock and Sandown should be positioned higher than Carlisle in the list; but Carlisle’s overall sample size was bigger and that swung it for me, along with an outstanding A/E index of 1.57 and excellent IV of 2.4. The figures for both of these metrics were the highest of the four C&Ds shared to date, and comfortably so.

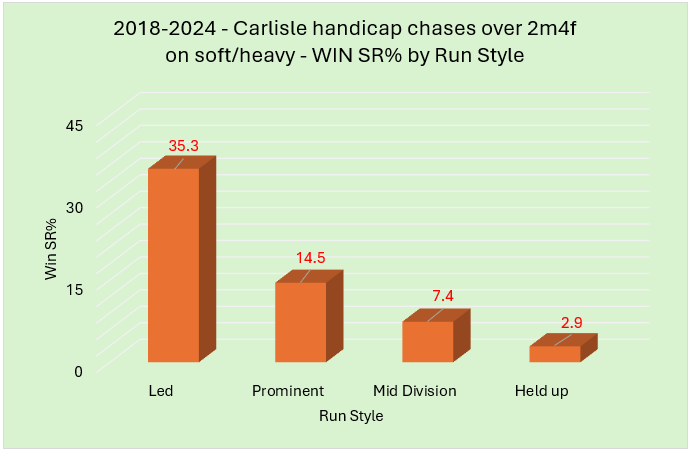

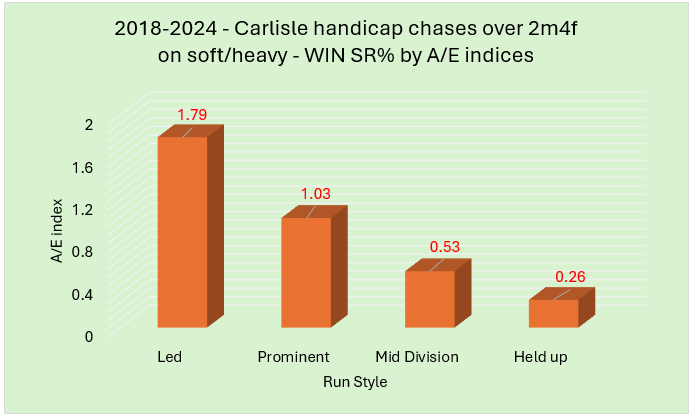

In terms of underfoot, once again we have seen a strengthening of the bias on softer ground. I will share the win strike rate percentages and the A/E indices once more. Firstly, the win stats:

Clearly, as with the 2m4f trips at Sandown and Haydock, on soft or heavy it has been hard to make up ground from further back. 21 of the 27 races were won by front runners (12 wins) or prominent racers (9). Hold up horses had a win rate of under 3% within their run style group which is the lowest figure seen to date.

The A/E indices positively correlate with the win SR%s as we would have expected:

A ‘led’ figure of 1.79 suggests huge value; not so for the 0.26 hold up A/E index.

One final front running stat to share for this track and trip combination is connected with those early leaders that were in the top three of the betting market. This collective won 16 races from 36 qualifiers which equates to a win rate of over 44%.

This year, at the time of writing, there have only been four qualifying races over this C&D (all going conditions), and three of the four have been won from the front.

#6 Doncaster 2m3f to 2m4½f

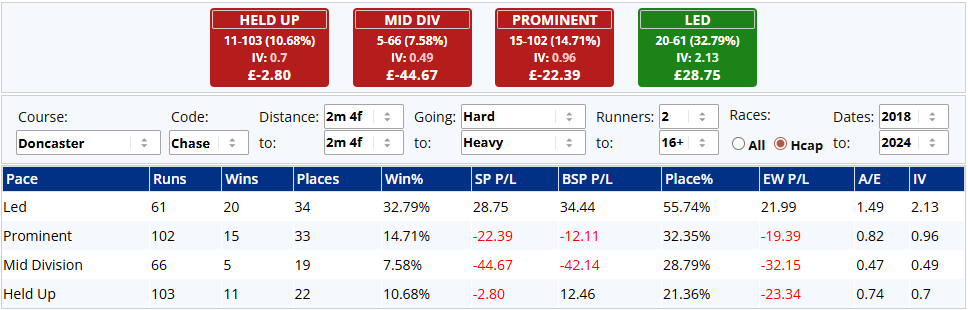

Onto Donny now to close out the first half of my top ten. They have races over similar distances from 2m3f to 2m4½f so all races within that distance band are included (2m4f for all on Geegeez Pace Analyser):

Front runners have won 20 of the 51 races and have an excellent placed record to boot. The ground is rarely testing at Doncaster, but on good to soft or softer the bias does seem to get even stronger:

11 of the 25 races, which equates to 44% of all races, were won from the front under these conditions.

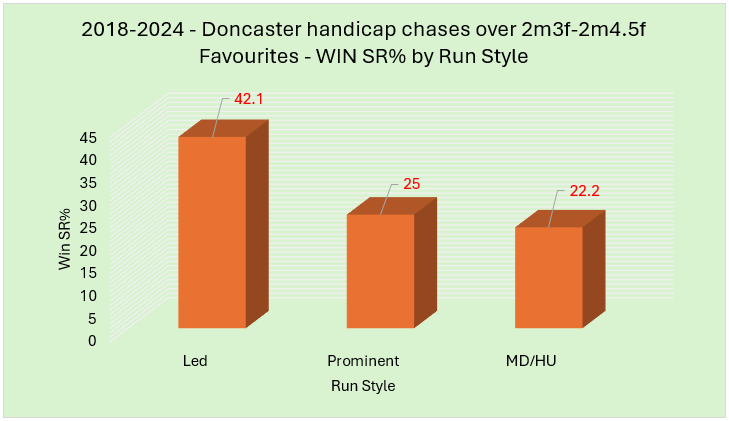

If we considered favourites only at Doncaster and their performance by run style, we have seen the following win strike rates splits (I have once again combined favourites whose run style was either Mid Div or Held Up):

Favourites that led early have been far more successful than other run style groups.

And that rounds out the lower half of my top ten. Next time it will be the top five, some even stronger biases than these! Until then...

- DR